In order to get approved for a mortgage, lenders look at a wide range of factors, including the type of property you want to buy and your credit score. You’ll be required to provide your bank statements and other financial documents as part of the mortgage application process. What does your bank statement tell your mortgage lender besides how much money you spend each month? Learn more about what your bank statement can reveal about your financial situation by reading on.

What Is A Bank Statement?

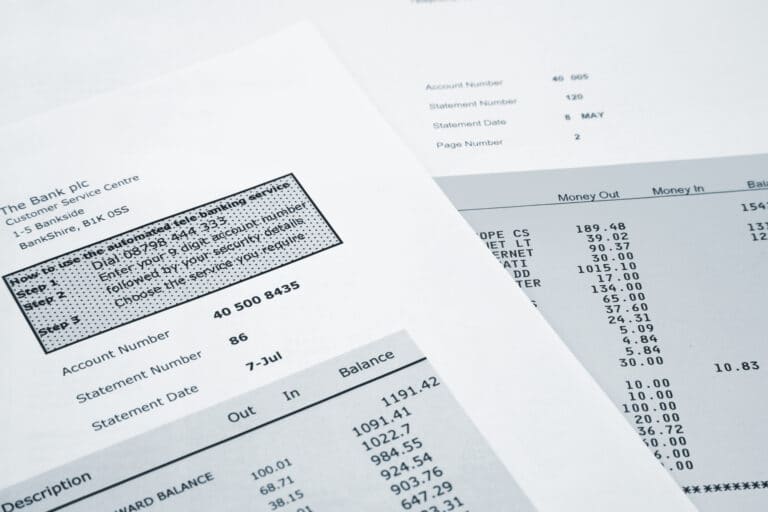

Bank statements are monthly or quarterly financial records that detail your banking activity. Your statements can be sent, emailed, or both. Bank statements let you keep track of your money and report errors swiftly. If you have both a checking and savings account, the activity will likely be merged.

Deposits

Money that has been deposited into your account is referred to as a deposit. The majority of your deposits may be made up of direct deposits, checks cashed, and wire transfers. As you earn interest, your bank will deposit funds into your account.

Withdrawals

Any money that has been transferred out of your account is shown by withdrawals. Your bank, for example, registers a withdrawal on your account whenever you make a purchase, use an ATM, or send a transfer online and bank to bank.

To What End Do Bank Statements Matter?

Bank statements are monthly or quarterly financial records that detail your banking activity. Your statements can be sent, emailed, or both. Bank statements let you keep track of your money and report errors swiftly. If you have both a checking and savings account, the activity will likely be merged.

Additionally, your bank statement will show you how much money you have in your account, as well as a list of all transactions, including deposits and withdrawals, over a given period.

Why Do Bank Statements Matter to Mortgage Lenders?

If you’re on your company’s payroll, you’ll most likely need to present recent pay stubs and W-2s to your lender. If you’re self-employed, you’ll need to provide your tax returns, as well as any other documentation requested by the lender.

Assuming that they already have this information, why do mortgage lenders need to review your bank statements?

In general, your lender will want to make sure you have enough income to meet your monthly payments and enough money in your account to provide a down payment. Your lender will also want to see that you have enough money to cover at least a few months of mortgage payments. During this process, they’ll most likely check all of your bank accounts.

Your lender is also looking over your bank statements to make sure your assets are “sourced and seasoned.” “Sourced” means the lender understands where your money is coming from. “Seasoned” indicates that all of your funds have been in your account for some time and were not recently deposited there. Both sourcing and seasoning serve to prevent fraud and money laundering, as well as reassuring your lender that you aren’t taking out a loan to pay for your down payment.

Finally, your bank statements will be examined by your lender to verify if you have enough money to cover closing costs. Closing costs are normally between 2% and 5% of the loan amount. To make sure you have enough money to pay off your loan, your mortgage company will check your liquid assets.

Is it necessary for me to provide multiple bank statements?

At least two bank statements are typically required. Lenders need multiple statements to ensure you haven’t taken out a loan or borrowed money from someone in order to qualify for your house loan. Because any loans taken out for more than two months would have previously appeared on your credit report, two is usually the ideal quantity.

Are Your Bank Statements Located Somewhere?

Your bank statements are easily accessible on your banking institution’s website. Here are a few basic procedures, though the webpage for each financial institution will differ slightly.

- Getting into your account

Use the bank or credit union’s website to access your account. You can call your bank’s customer service department for help if you forget your login information.

- Obtain a Copy of Your Account Statements

You should notice a number of links to PDF files labeled “Statement” and the dates associated with them on this tab. Find the appropriate statement and save it. Save the files in a location where you’ll have easy access to them. If the filename is a jumble of numbers and letters, rename it to something you and your lender will recognize. At least two statements from each of your accounts should be delivered to the lender with a name such as “February account statement, Bank of America.”

What are the underwriters looking for in bank statements?

Underwriting is a method used by lenders to verify your income. You’ll need an underwriter to conduct research and assess your risk level before a lender will accept your loan. After underwriting is complete, your lender will inform you if you are eligible for a home loan. During the loan application process, underwriters look for a few red flags in your bank statements.

- Uncertain Income

Lenders require proof that you will be able to make your mortgage payments on schedule. Paychecks, royalties, and court-ordered payments like alimony are all examples of regular sources of income that underwriters look for.

Why has your income changed substantially in the last two months? If they call, have a written explanation ready. A new job offer letter that contains your start date qualifies. If you’re self-employed, your lender may require two months of bank statements.

- Not Enough Savings

Paying your mortgage if you lose your work or are sick? Lenders want to know if you have enough saved to pay off your mortgage. A few months’ worth of payments is usually required by most lenders. Affordability of down payment and closing costs.

- Unstoppable Cash Flow

A large, sudden deposit of cash is a major red flag for lenders. In some cases, it may show up on a lender’s credit report as a down payment loan. A down payment is meant to help you build equity in your home and lower your mortgage payments. Taking out a loan for your down payment defeats the purpose of the payment and adds to your debt load, potentially causing future financial issues.

There are occasions when a rapid increase in savings is justified. You may have received a monetary present from a family member or started a new job with a sign-on bonus. Before you submit your statements, be sure you have evidence that proves where the money originated from.

To help you get started, perhaps your parents gave you a large quantity of money. A copy of the transfer slip or bank account statement, as well as a letter from your parents stating that the money does not need to be repaid, may be required as proof.

- Overdrafts

An overdraft occurs when you use more money than you have in your account. Most banks incur overdraft fees, and underwriters know about them. In spite of the fact that everyone can make mistakes, mortgage lenders consider regular overdrafts a red indicator.

The fact that your account is frequently overdrawn may suggest that you underestimate your financial status. Borrowing above your means is another possible reason for the debt. Any overdraft fees that were charged to your account should be explained.

The End of the Road

All your bank transactions are listed on a monthly or quarterly basis on a bank statement. If you’re applying for a mortgage, lenders will look at your bank statements and other paperwork to see if you’re a good candidate.

Keep your finances in order and respond quickly to your lender’s demands for financial information. Once you’ve been debt-free for six months, apply for a mortgage. Watch your account balances to avoid overdrafts. If your lender requests further bank statements or explanations, be ready to provide them.